For 2021-22, if you are single and of age pension age or over, you only pay tax once you receive a taxable income of $33,898 or more. Finally, in your question you refer to 'old' age pensioner.. Yes, Australian retirees are still required to pay CGT. There is no age limit exemption that allows seniors to avoid paying CGT. The ATO treats capital gains as part of your overall taxable income. So even after you enter your pension phase and are no longer earning a salary, you still must report capital gains and losses on your annual income.

Make taxfree capital gains on Australian shares whilst a nonresident expat Expat Taxes Australia

Understanding Capital Gains Tax A Comprehensive Guide

Do retirees pay capital gains tax in Australia? Expat US Tax

Capital gains tax on shares in Australia explained

Do retirees pay capital gains tax in Australia? Expat US Tax

How to Avoid Capital Gains Tax on Investment Property Pherrus

Capital Gains Tax Easy Way to Pay More! YouTube

Calculating Capital Gains Tax (CGT) in Australia

Do Retirees Pay Capital Gains Tax in Australia? WealthVisory

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns & Webber Estate Agents

How Much is Capital Gains Tax in Australia The Key Facts OdinTax

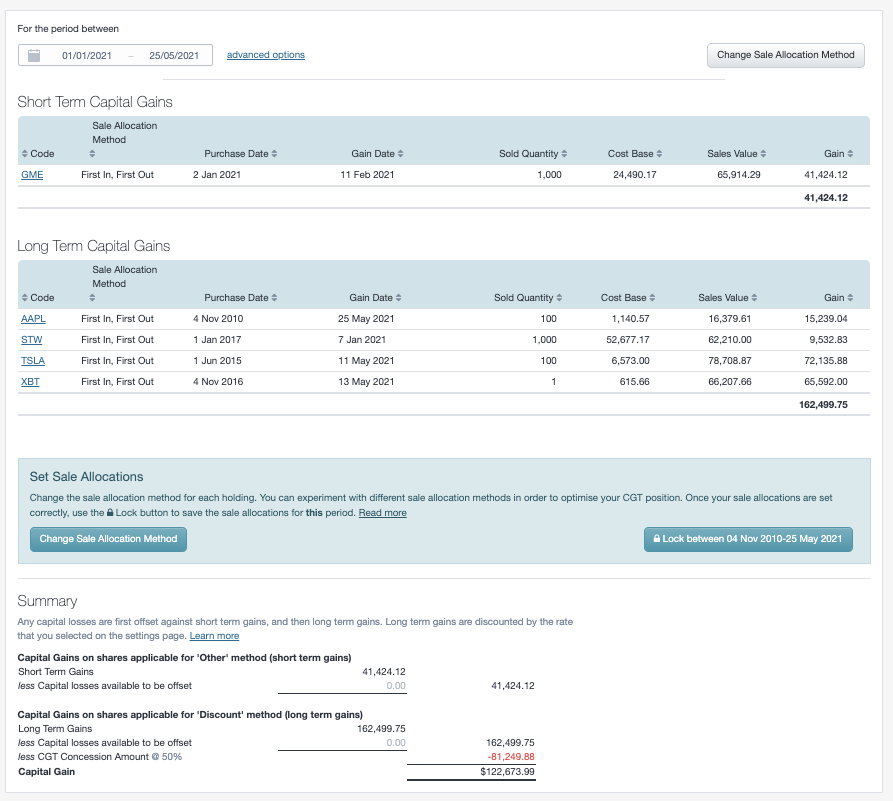

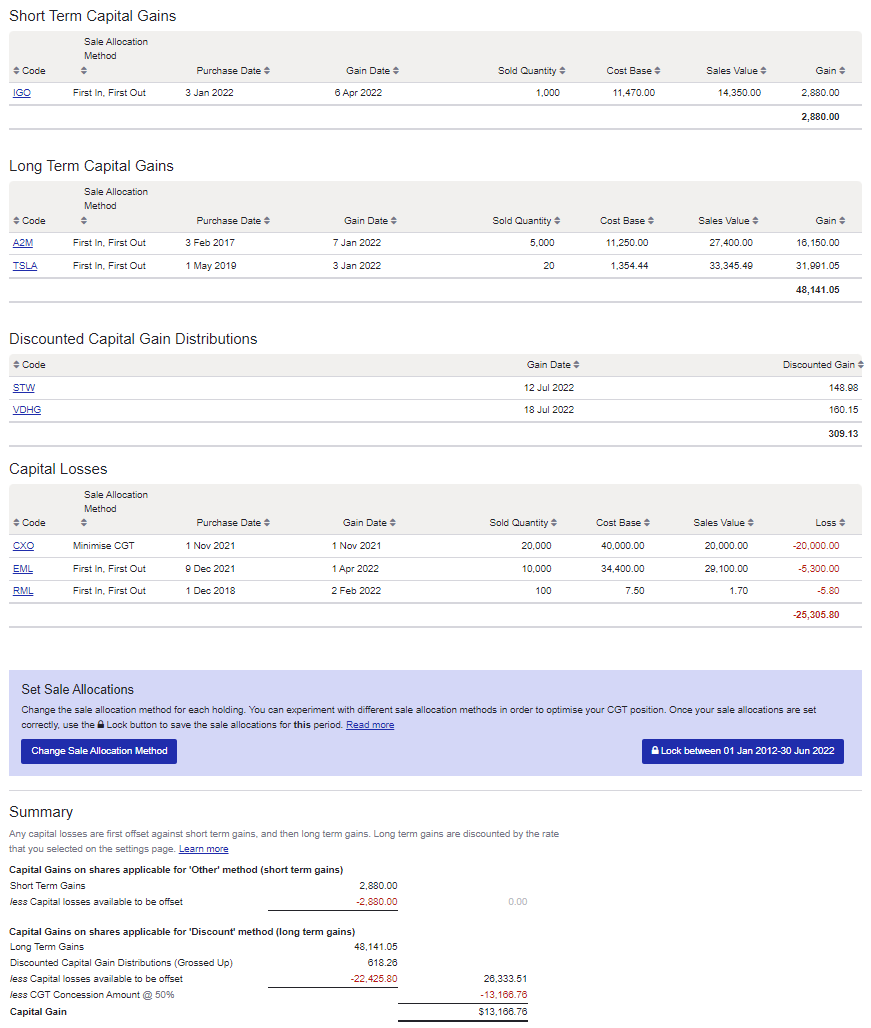

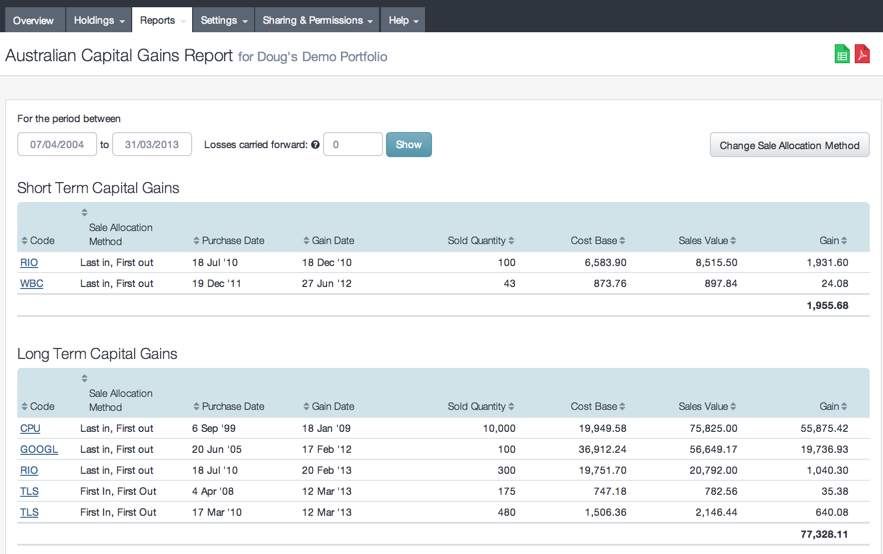

Capital gains tax (CGT) calculator for Australian investors Sharesight

Do Retirees Pay Capital Gains Tax in Australia? WealthVisory

The Beginner's Guide to Capital Gains Tax + Infographic Transform Property Consulting

Do Retirees Pay Capital Gains Tax in Australia? Ripyard

Capital gains tax (CGT) calculator for Australian investors Sharesight Blog

Do retirees pay capital gains tax in Australia? YouTube

Capital Gains vs. Ordinary The Differences + 3 Tax Planning Strategies Kindness

How do I run an Australian capital gains tax report? Sharesight

Capital Gains Tax Concessions when selling your business

less than it cost you - you have a capital loss. You pay tax on your net capital gains. This is: your total capital gains; less any capital losses; less any discount you are entitled to on your gains. There is a capital gains tax (CGT) discount of 50% for Australian individuals who own an asset for 12 months or more. This means you pay tax on.. Capital Gains Tax for People Over 65. For individuals over 65, capital gains tax applies at 0% for long-term gains on assets held over a year and 15% for short-term gains under a year. Despite age, the IRS determines tax based on asset sale profits, with no special breaks for those 65 and older. It's essential to understand these rates and any.